oregon statewide transit tax exemption

Oregon State Transit Tax Exemptions will sometimes glitch and take you a long time to try different solutions. There is no maximum wage base.

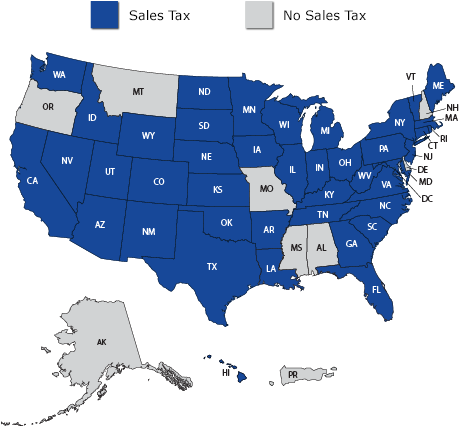

Taxes On Unemployment Benefits A State By State Guide Kiplinger

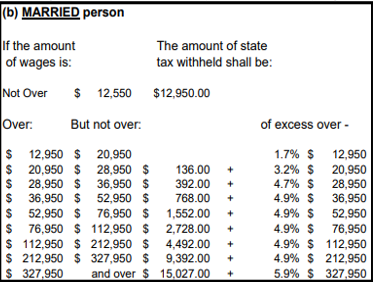

Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of where the work is performed and 2.

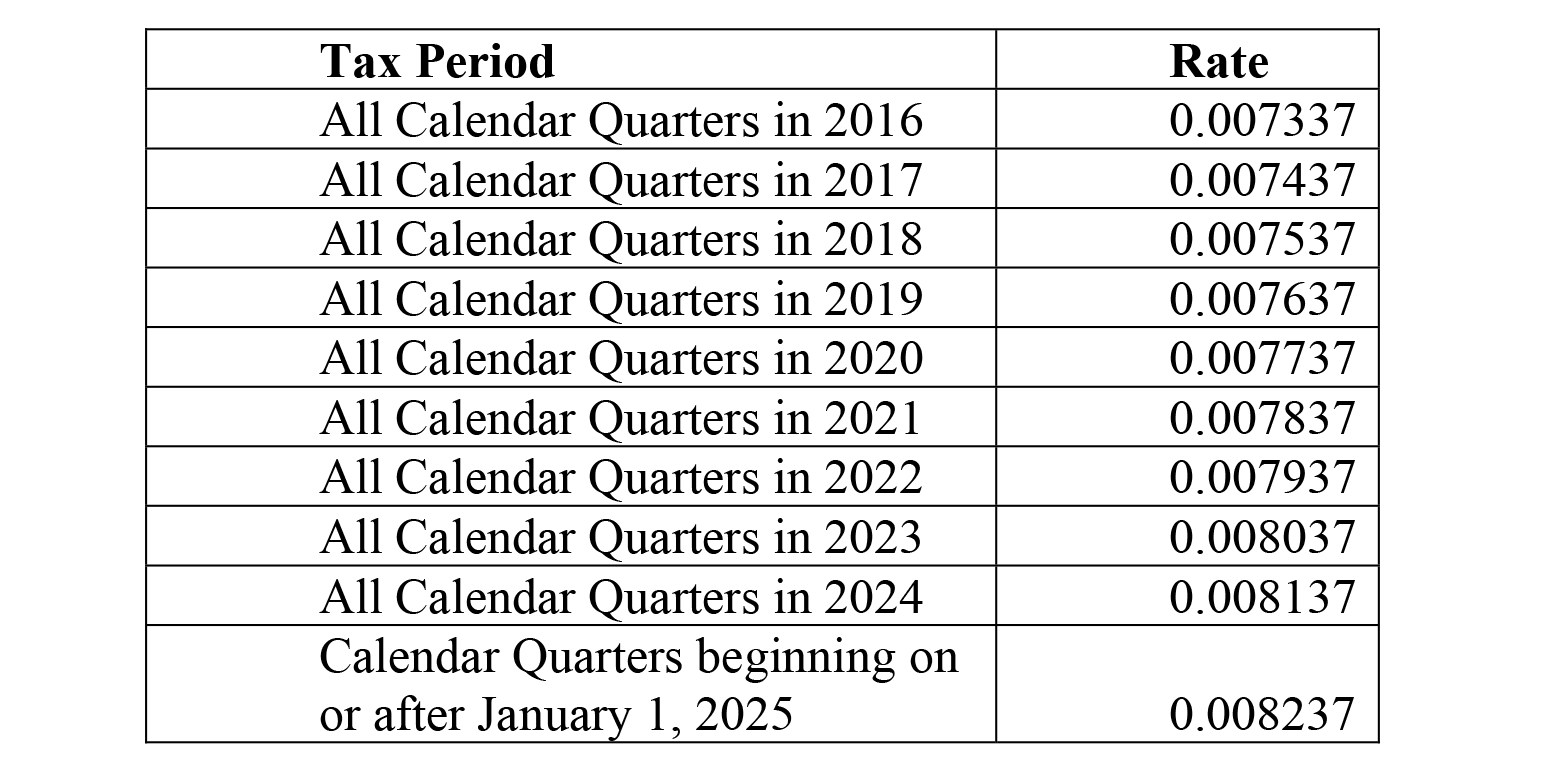

. On July 1 2018. Employers are also required to. Under Oregons new Statewide Transit Tax employers must start withholding the tax one-tenth of 1 percent or 01 from wages of Oregon residents.

Effective July 1 2018 Oregon workers must pay a Statewide Transit Tax to the state of Oregon at the rate of 001 01 on income that is subject to Oregon state. The tax rate is 010 percent. From the Oregon Department of Revenue website.

LoginAsk is here to help you access Oregon State Transit Tax. The transit tax will include the following. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax.

Transit payroll taxes are a tax on the employer that is paid by the employer based on the amount of payroll earned. This requirement mirrors the requirements for state income tax withholding. Oregon employers must withhold 01 0001 from each employees gross.

If not offered at affordable housing rates. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Unless there is a regulation under Texas law if they have employees in Oregon they need to withhold Oregon tax.

A Statewide transit tax is being implemented for the State of Oregon. July 1 2018. Multi-Unit Property Tax Exemption MUPTE Units may be offered at market rate if affordable housing isnt one of the stated public benefits.

On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. Oregon tax expenditure report. Parts of HB 2017 related to the statewide transit tax were.

Rule 150-267-0020 Oregon Department of Revenue Rule 150-267-0020 Wages Exempt From Transit Payroll Tax For purposes of the transit district payroll taxes certain payrolls are.

News Update For District 15 October 22 2021

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Transit Tax Procare Support

Fill Free Fillable Forms For The State Of Oregon

Wfr Oregon State Fixes 2022 Resourcing Edge

Georgia Pacific Strategic Investment Program Lincoln County Oregon

Transit Payroll Tax Information City Of Wilsonville Oregon

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax Statewide Local

2019 Form Or Stt 1 Fill Out Sign Online Dochub

Columbia County Oregon Official Website Oregon State Senate Bill 48 Goes Into Effect On July 1 2022

Oregon Metro Refers Multibillion Dollar Transportation Bond Measure To November Ballot Opb